Category: transportation funding

regional block grants for transportation

This week’s podcast Talking Headways Podcast: Localities Subsidize the State DOT, Talking Headways, Jeff Wood, was an interview with Adie Tomer of Brookings Institution about a research paper recommending that some federal transportation funding go directly to regional government, MPOs (Metropolitan Planning Organizations) and COGs (Council of Governments), rather than through state departments of transportation. The paper points out that in most cases local governments are subsidizing the state DOT, giving more money to the state than they are getting. The solution suggested is regional block grants (Regional block grants: A new approach to funding transformative infrastructure projects, Brookings Institution, 2025-05-08).

“Regions are the economic hubs of the nation, with metropolitan areas alone producing 90% of gross domestic product in 2023.”

“Regional infrastructure needs are complex, outpacing existing federal funding mechanisms. Formula funds primarily flow to states, while regional actors struggle to qualify for many competitive grants.”

“A new federal model should empower regions and their localities directly. Regional block grants can equip regions with predictable, flexible funding to deliver transformative infrastructure.”

I love the idea! Caltrans gets state funding, and gets a portion of SACOG funding, and a portion of Sacramento Transportation Authority funding. That allows Caltrans to continue to widen freeways and build interchanges, while local roads are pocked with potholes. We have ever fancier freeways with ever expanding lanes. Why? We don’t need that, it contributes nothing to solving our transportation needs, but just induces more driving and more congestion and more pollution and more crashes.

There is a constant tension at the SACOG Board when Caltrans demands funds that come from the state and other sources, for their pet projects. Same at SacTA, when Caltrans demands funds that come from local sales tax. Time to end this!

I encourage you to listen to the podcast, available on any podcast reader, and check the Brookings research paper.

transportation funding update

alternatives to transportation sales tax

Sales taxes are regressive, in that lower income people pay a higher percentage of their income in sales tax than do higher income people. In Sacramento area, a new transportation sales tax measure is being talked about, whether for transportation in general, or for transit specifically. No proposals have been made, but there are certainly many discussions in many arenas.

The San Francisco Bay Area is also having the same discussions. There is legislation to authorize a transportation sales tax measure in up to five Bay Area counties. A recent KQED article (Proposed Transit Tax Should Be Paid by Businesses, Not People, Progressive Group Says) talks about discussions, and an alternative proposal to use a business gross receipts tax instead of sales tax. It is true that any tax ultimately comes out of the pockets of citizens, but a gross receipts tax is better distributed and not as regressive.

I have a concern that politicians again and again go to the default of sales taxes because it seems easier to sell. But sales tax rates are already very high, and there is increasing evidence that voters will not go for a higher sales tax rate, no matter what the topic or the benefit.

I’ll write more about funding options in the future. Past posts include Is sales tax for transportation the wrong approach?, transportation funding ideas, and many, many others under the category: transportation funding. I was amazed, looking back, at how many times I’ve posted about transportation funding and tax measures.

AB 1223 for wider SacTA authority

AB 1223: Local Transportation Authority and Improvement Act: Sacramento Transportation Authority (Nguyen/Krell) has been introduced in this legislative session. As of April 2, it is still in the Assembly Local Government Committee.

“The bill would provide that the allowable expenditure categories for revenues from a tax imposed by STA include the construction, modernization, and improvement of infrastructure, as defined, that supports infill or transit-oriented development and would reduce vehicle miles traveled.” It would also allow Sacramento Transportation Authority (SacTA) to develop and operate toll facilities, and to impose taxes on areas of less than the entire county.

SacTA is currently operating under general state legislation, and the Measure A code that established the authority. The authority now wishes to make clear that expenditures which broaden the mission to more transportation and infrastructure projects that support transportation are within the purview of the authority.

It isn’t clear to me how the toll facilities ability would mesh with the Capitol Area Regional Tolling Authority (CARTA) which is intended to cover the SACOG region.

The less than-full-county voting area is similar to that implemented for SacRT, but does not require that two or more cities be adjacent, as does the SacRT legislation. The idea is the same, that some areas of the county will be opposed to any sales tax measure, no matter what it contains, so creating a measure that targets supporting areas makes sense.

Is sales tax for transportation the wrong approach?

There are three ideas for transportation funding floating around, for the 2026 ballot, though none have been formalized. All rely on sales tax.

- Sacramento Transportation Authority (SacTA) may create a ballot measure to fund transportation. It would be in addition to the existing Measure A, and might fund transportation infrastructure for infill housing, which has not been done before. As an agency-sponsored measure, it would require 2/3 vote to pass.

- Sacramento Metro Rail and Transit Advocates (SMART) and Mayor Darrell Steinberg have drafted measure that would fund active transportation, transit, and housing. It would probably be for the county, but could be just for the City of Sacramento. As a citizen initiative, it would require only 50% + 1 to pass, a much more achievable vote.

- SacRT it considering a measure for transit and related active transportation that might cover only a part of Sacramento County, the more transit-supportive part, probably the cities of Sacramento and Elk Grove. As an agency-sponsored measure, it would require 2/3 vote to pass.

Sales taxes are regressive, meaning that low-income people pay a much larger percentage of their income to sales tax versus high-income people. Most organizations which lead with equity are opposed to further sales tax increases, feeling that enough is enough.

In Sacramento County, with a strong anti-tax voice in the low density unincorporated county, it is difficult though not impossible to reach the 2/3 threshold. The 2016 transportation sales tax fell short of 2/3. Measures to fund schools districts are more likely to pass. A complicating issue is that Elk Grove recently passed a sales tax measure to fund many purposes, one of which is transportation. Folsom and Rancho Cordova have sales taxes for which it isn’t clear to me whether any goes to transportation.

General purpose sales tax measures, which may list uses but are not required to follow those lists, only require 50% + 1 to pass. That flexibility is both a feature and a danger, since a government may shift sales tax income from what they said it would be spent on to other purposes.

Though I have not heard parcel taxes being discussed, they are another source of funding, though they are also regressive because they are a flat rate per parcel, not based on the value of the parcel.

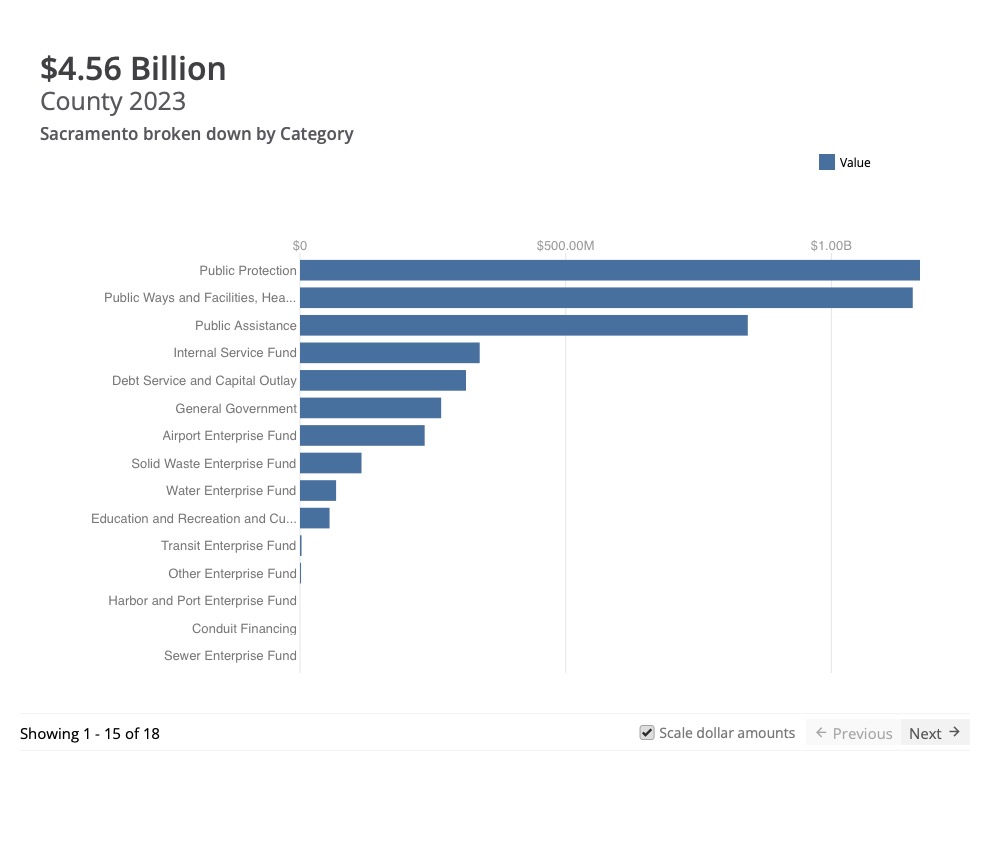

Two other types of tax which are progressive, meaning that high-income people pay a higher percentage of income than low-income people, are income tax and property tax. Income tax does fund transportation at the state level, but income taxes are not available to cities, counties, and special districts. Property tax can fund transportation, though due to Prop 13 which limits property tax, it mostly goes to schools and public safety. For Sacramento County in 2023, the chart below shows allocations. The ‘Public Ways and Facilities, Health, and Sanitation’ category goes mostly to Health, with Public Ways and Facilities being less than 20% of that category. This chart does not include school districts within the county, which also rely on property tax.

Transfer taxes, which are based on the value of a property when it is sold, are progressive. These have been discussed in a number of places in California, though not locally so far as I have heard. I am not aware of any existing transfer taxes that fund transportation, though they do fund a number of other government functions. The state levies a transfer tax throughout the state, and that income goes into the general fund.

Any county, city or special district can bond against property tax, meaning that they can expend money now and pay it back over time from future property tax income. Again, Prop 13 limits the usefulness of this by suppressing property tax income, but does not preclude it. If Prop 5 on the 2024 ballot passes, cities, counties, and special districts will be able pass bond measures with a 55% vote rather than 2/3 vote, though the proposition raises the bar on transparency and types of expenditures. Though Prop 5 is intended primarily to fund housing, it could fund transportation, and there is a logical nexus with transportation that supports housing.

For other posts on transportation funding, see category Transportation Funding.

what’s going on? (other)

There are so many actions and possibilities for improving the efficient, equity, and safety of our transportation system that I can’t keep up with it all, and even nonprofits that have staff are unable to keep up. So, what’s going on? The list below is not in any priority order, but may give you ideas about what you would like to get involved in. It takes a village!

Items specific to City of Sacramento were in a previous post, while these items are about other locations, and/or applicable to all the cities and counties in the region.

Transportation funding in Sacramento County: Transportation sales tax measures in 2016 and 2022 failed, and a 2020 measure was withdrawn. Each measure was weak on active transportation and transit (and the sprawl developer sponsored ‘citizens initiative’ in 2022 was horrible), and also suffered from anti-tax sentiment in the county. There are three efforts to place a funding measure on the 2026 ballot, Sacramento Transit Authority (SacTA) new Measure A, SMART/Steinberg citizen measure for housing, active transportation, and roadway maintenance, and SacRT transit measure for City of Sacramento and Elk Grove. All of these are in early stages, not yet formalized. Sales taxes are regressive, making low-income people pay a much higher percentage of their income on these taxes, so efforts to identify other mechanisms are critically important.

City of Rancho Cordova Active Transportation Plan: The city is starting the process of community engagement towards developing a plan for walking, rolling and bicycling.

Other active transportation plans: Sacramento County updated its plan in 2022. Folsom updated its plan in 2022. It isn’t clear what the status of Elk Grove’s Bicycle, Pedestrian, And Trails Master Plan is. West Sacramento’s Bicycle, Pedestrian, and Trails Master Plan, from 2018, received minor updates in 2024. Roseville is undertaking a Transportation 360 effort to include walking, bicycling and transit. Davis does not seem to have an active transportation plan.

Sacramento County Climate Action Plan: The county has delayed a climate action plan by years, going through a series of revisions that aren’t much better than the previous. Sacramento Climate Coalition and 350Sacramento have been the most active on this issue. It will take citizen pressure on staff and on the Board of Supervisors to ensure an effective plan.

Other climate action plans: Every city and county is required to come up with a climate action plan. I don’t know the status of plans other than City of Sacramento and Sacramento County.

SACOG 2025 Blueprint: SACOG is developing a new version of the MTP/SCS called Blueprint ‘Linking land use and transportation in the Sacramento region’. There is a constant tension between the desires of cities, in particular Sacramento, West Sacramento, and Davis, and the smaller cities and rural counties of the six county SACOG region, over what kinds of transportation investment to make. SACOG is required to come up with a plan that would reduce greenhouse gas emissions (GHG) by 19%, and the transportation policies and projects selected will make all the difference in whether the region has a chance for achieving that goal. Citizen pressure for infill and livable communities is required to counteract the small city and rural voices that just want money to continue doing what they’ve always done, which is encourage low density sprawl development with a motor-vehicle focused transportation network.

Caltrans District 3: While other entities are beginning to meet the public demand and legal requirements to reduce greenhouse gas emissions (GHG) by reducing vehicle miles traveled (VMT), and improve roadway safety, Caltrans District 3 is continuing to expand highway capacity, inducing travel demand and increasing GHG/VMT, and making it very hard for cities and counties to make their roadways that are state highways or that cross state highways (underpasses and overpasses) to improve safety. Caltrans headquarters has been unable to rein in District 3.

This list no doubt misses some important topics. Please suggest them in the comments.

Prop 5 bonding for transportation?

Proposition 5

A Yes on 5 website offers details in support of the proposition. The arguments against, on the voter information guide, are just the standard anti-tax voice, so isn’t useful to this post, but you can read your guide if you are interested. Prop 5 was placed on the ballot by the legislature, as a result of two legislative resolutions. The proposition is entitled “Proposition 5: Allows Local Bonds for Affordable Housing and Public Infrastructure with 55% Voter Approval.“

The proposition would change the voting threshold from two-thirds, 67%, to 55%, for ballot measures by cities, counties and special districts (does this include SacRT?) that bond against property taxes for the purposes of affordable housing and public infrastructure. The proposition does not directly raise property taxes, nor would local bonding measures directly raise taxes, though since the bonds have to be repaid with interest, property taxes could eventually go up within the limits sets by other legislation. This has nothing to do with sales tax, which remains at two-thirds for govenment proposed sales taxes, and 50%+1 for citizen proposed measures.

The history of the proposal development indicates that it is more about affordable housing than public infrastructure, but infrastructure is definitely allowed, and could easily be justified when that infrastructure supports affordable housing. It can also apply to transportation infrastructure. The specific language in the ballot measure related to infrastructure is “construction, reconstruction, rehabilitation, or replacement of public infrastructure”, which is pretty open-ended. More specifically, the proposition lists the following infrastructure uses:

(I) Facilities or infrastructure for the delivery of public services, including education, police, fire protection, parks, recreation, open space, emergency medical, public health, libraries, flood protection, streets or highways, seaports, public transit, railroad, airports, and

(II) Utility, common carrier or other similar projects, including energy-related, communication-related, water-related, and wastewater-related facilities or infrastructure.

(III) Projects identified by the State or local government for recovery from natural disasters.

(IV) Equipment related to fire suppression, emergency response equipment, or interoperable communications equipment for direct and exclusive use by fire, emergency response, police, or sheriff personnel.

(V) Projects that provide protection of property from sea level rise.

(VI) Projects that provide public broadband internet access service expansion in underserved areas.

(VII) Private uses incidental to, or necessary for, the public infrastructure.

(VIII) Grants to homeowners for the purposes of structure hardening of homes and structures, as defined in state law.

The reason for raising this issue is that taxes based on property are progressive, meaning that people with higher incomes and therefore higher value property, pay more in taxes. Sales taxes are regressive, meaning that low-income people pay a higher percentage of their income on taxes than do higher income people. Proposals to increase the sales tax in Sacramento County have been resisted by many who think we have runs out that option and need to turn to options that are not regressive, like property tax.

I prefer pay-as-you go expenditures from most transportation projects, except for a few which are very expensive and of clear benefit to everyone. There are few transportation projects that would or should quality for this. The transportation projects we most need going forward are many small fixes, not the mega-projects done in the past which tend to be motor vehicle projects. But some transit projects could be or should be bonded. The problem with bonding is that interest payments raise the cost to about 1-1/2 times the project cost, depending on the bond length and bone rates, and that money goes to wall street investors, not to the project.

I am in favor of the proposition. It gives local governments, and therefore citizens, control over how they spend their property tax, rather than being constrained by statewide controls that were implemented by anti-tax interests.

If the proposition passes, would it be the solution, or a solution, to funding affordable housing and transportation infrastructure instead of or in addition to sales tax or other taxes and fees? I don’t know, but I do think it is worth exploring. Though the proposition applies to local measures on the same ballot, there are no transportation measures of any sort on the 2024 ballot in Sacramento Couny. There may be in 2026, as a Sacramento Transportation Authority new Measure A transportation sales tax, or a SacRT sales tax for transit with a limited geography, a citizen measure sales tax for housing, transportation, and active transportation (the SMART/Steinberg proposal), or other ideas that have not yet come forward. A property transfer tax has been discussed, which is another progressive tax. The state has a property transfer tax, as do other entities. It isn’t clear to me whether Sacramento County or any of the cities within the county have transfer taxes.

Yuba City sales tax for transportation+

SacBee: Yuba City voters will decide on an unorthodox sales tax. How will it work, what does it pay for?

Yuba City will be placing on the November ballot Measure D sales tax that includes ‘Roads – tackling the $150 million in deferred maintenance on our local roads’. It is a general purpose sales tax measure, so the city can change how funds are allocated after it passes (as happened with some of the City of Sacramento Measure U funds), but it is interesting that a small city in the Sacramento region is taking the initiative to fix its roads, when others are not.

Elk Grove passed Measure E, a one-cent sales tax measure, also a general measure, which includes ‘Maintaining Streets and Improving Traffic’. Rancho Cordova passed Measures R and H to ‘to improve city streets’ among other general purposes. There may be others. Sacramento County has been unable to pass a sales tax measure for transportation since 2009’s Measure A, which is in effect through 2039, though there may be a ballot measure in 2026. The City of Sacramento has not passed a sales tax measure for transportation. Measure U did not include a call-out for transportation, though as a general measure, funds could be used for transportation.

a tax JUST to fix roads?

While attending the Sacramento Transportation Authority meeting last Thursday, and hearing the long painful discussion about how there isn’t, and never will be, enough money to fix our roads to the level that the public desires, a thought occurred to me. Keeping roads in good shape is often called ‘fix-it-first’ or ‘state of good repair’.

What about a sales tax of a quarter cent, JUST for maintaining roads? It would have a short term, perhaps 10 years, with language included that it could not be extended. It would only be for fixing pavement. It would not includes complete streets or sidewalks. It could include the addition of regular bike lanes as the street is re-striped after paving, but would not include high quality bike facilities. It would include language to ensure that it is not used to expand roadway capacity or to build new roads.

I know that many of my transportation advocacy friends are cringing. What about all the other things that need to be fixed? What about missing sidewalks? What about complete streets? What about traffic calming? Yes, all of those are important, and must be funded in some way. But useable streets are the base of everything else we do for mobility and access. Sacramento area streets are certainly not the worst in California. I know that Los Angeles, and San Francisco, and parts of Oakland, are much worse.

There would also be a tremendous question of fairness. The tax would be collected from all citizens of the county, but most of it would be spent in unincorporated Sacramento County. The county has a long, long history of underinvesting in its roads, building new but not maintaining. That keeps taxes lower, which is in part why there are so many anti-tax people in unincorporated county, but it does not create useable roads. Should the rest of the county be responsible for fixing the county’s underinvestment? Its a fair question.