Alex Lee introduced, in the last legislative session, AB 362, ‘Real property taxation: land value taxation study’. “This bill would require the California Department of Tax and Fee Administration to conduct or commission a study on the efficacy of a statewide land value taxation system as an alternative to the current appraisal methods utilized for real property taxation.” It got to the Assembly Committee on Revenue and Taxation, but no further. It is, I believe, a two year bill and can be considered in 2024 session.

So what is land value tax? It is a property tax assessed on the value of the land itself, and not on the improvement to the parcel such as buildings. Current property tax in California is based on both, called split-roll, but strongly weighted towards the value of the improvements, not the land. A pure land value tax would shfit entirely to taxing the land, but blended taxes with a shift towards land value would have some beneficial effects.

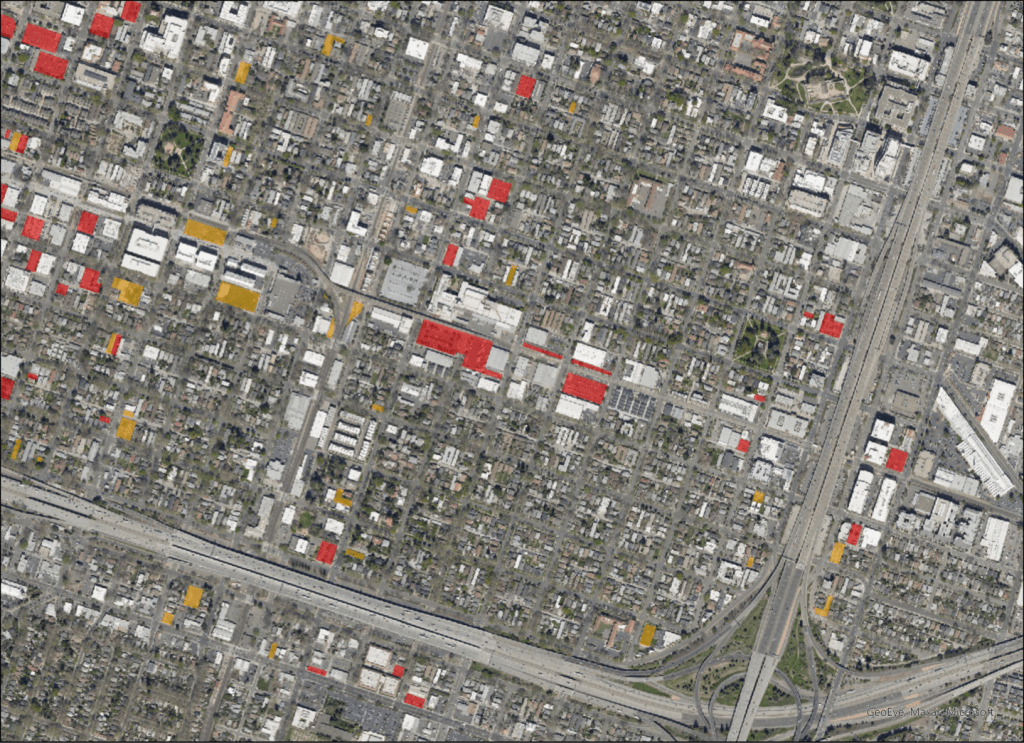

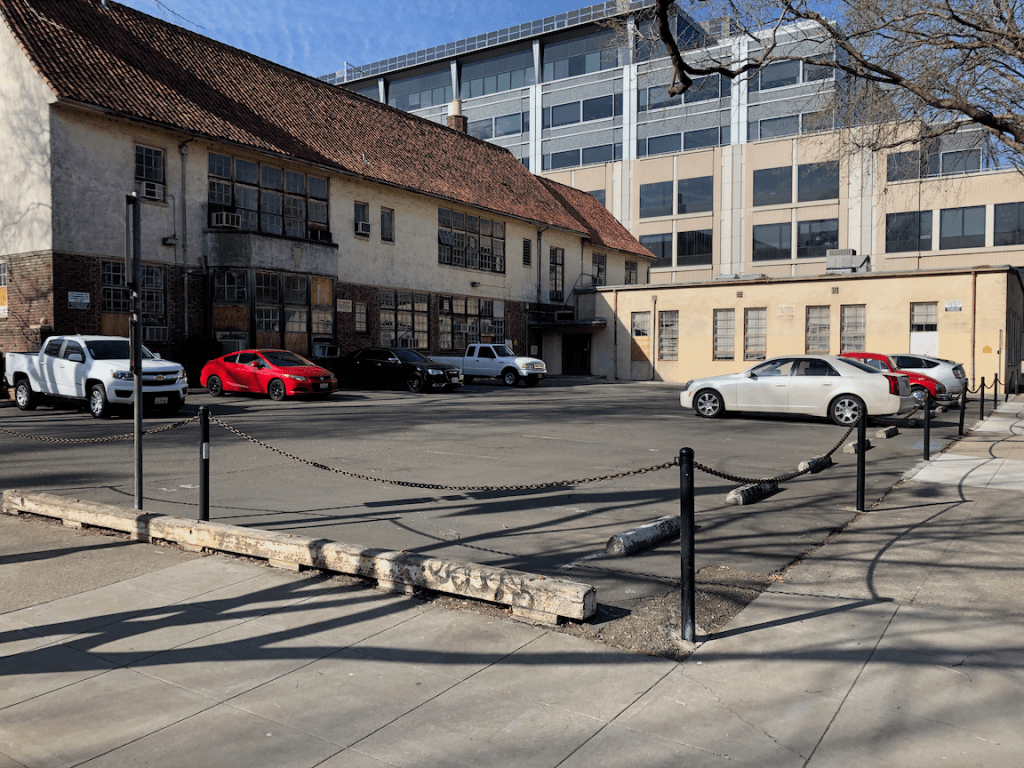

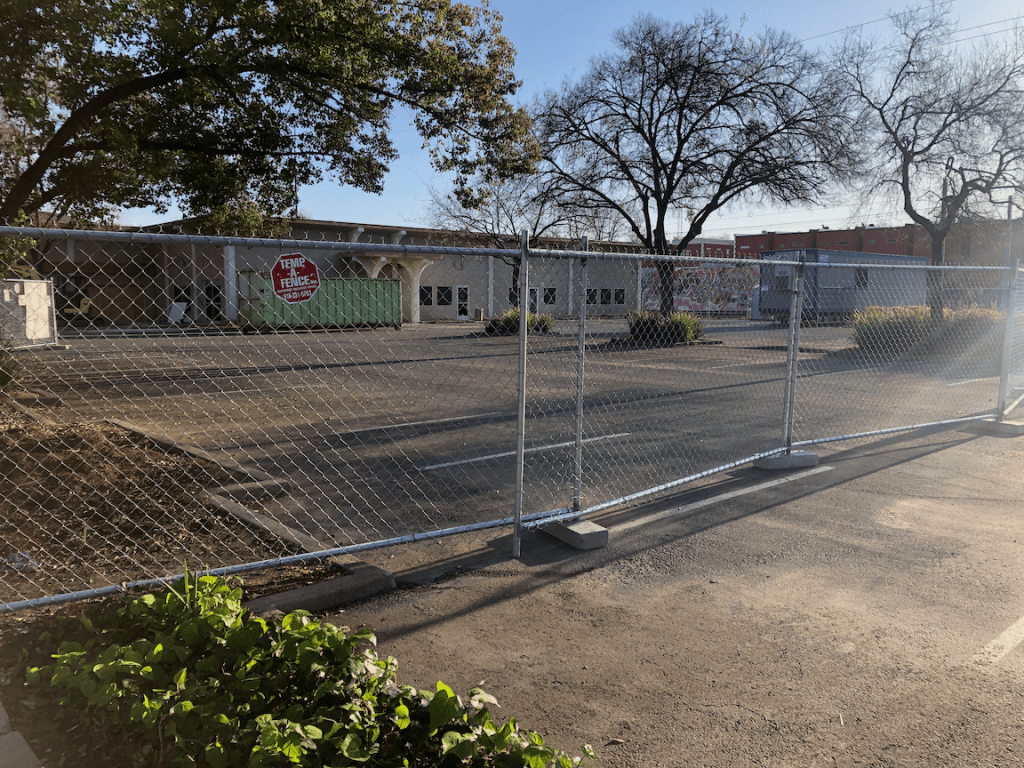

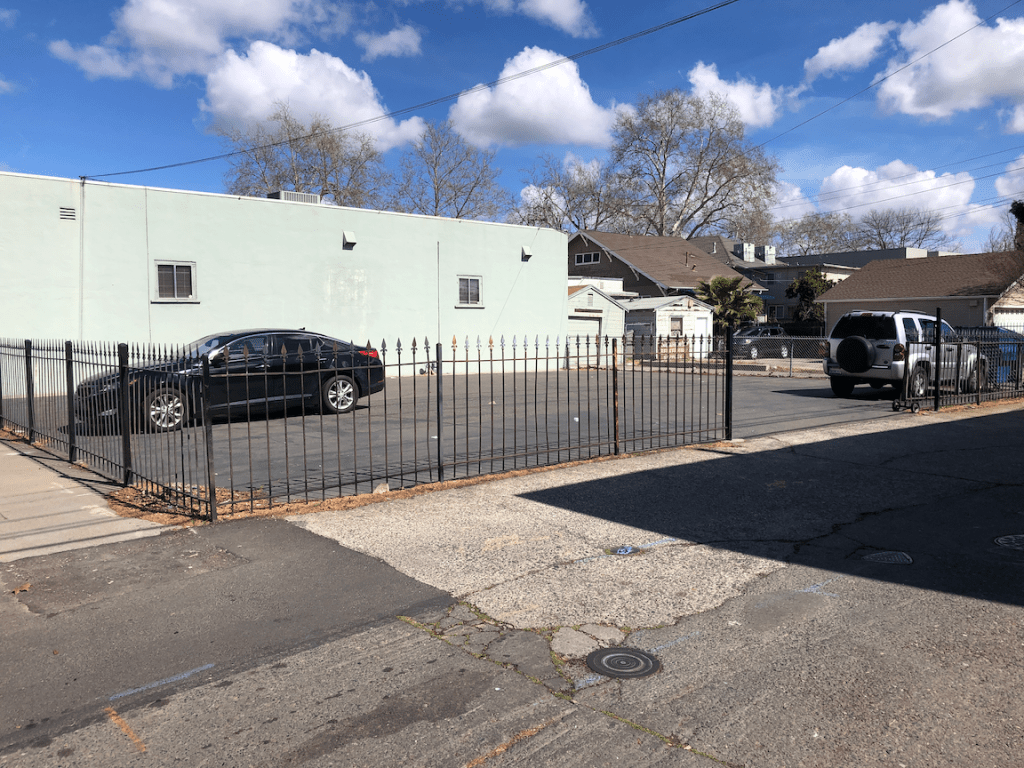

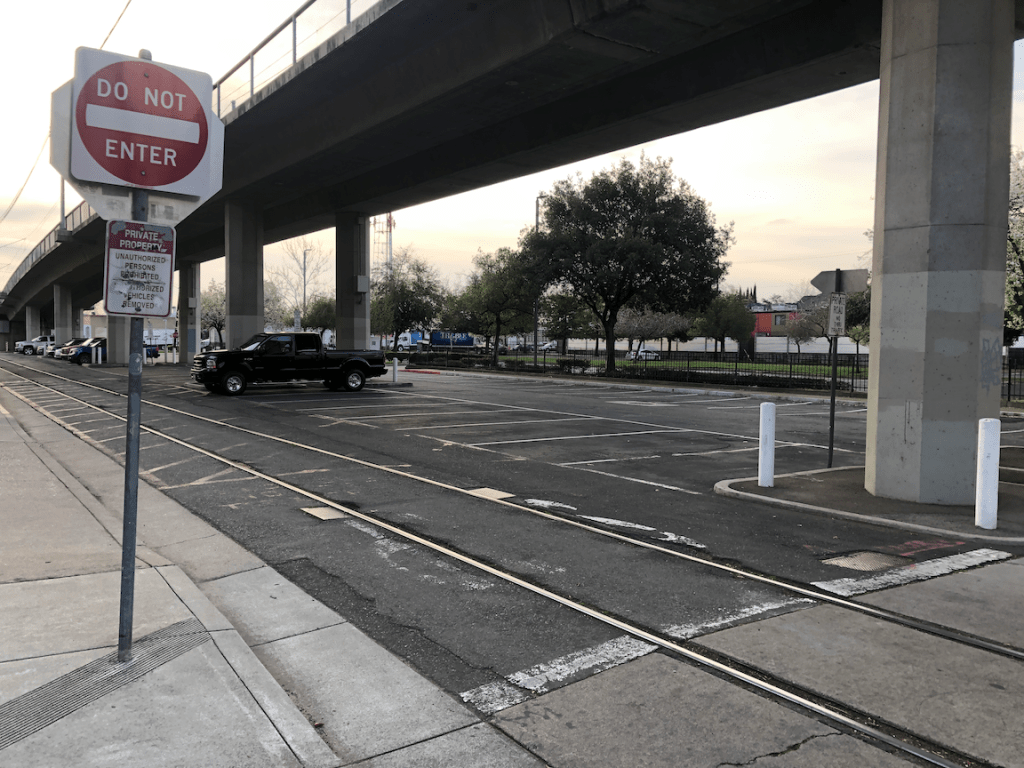

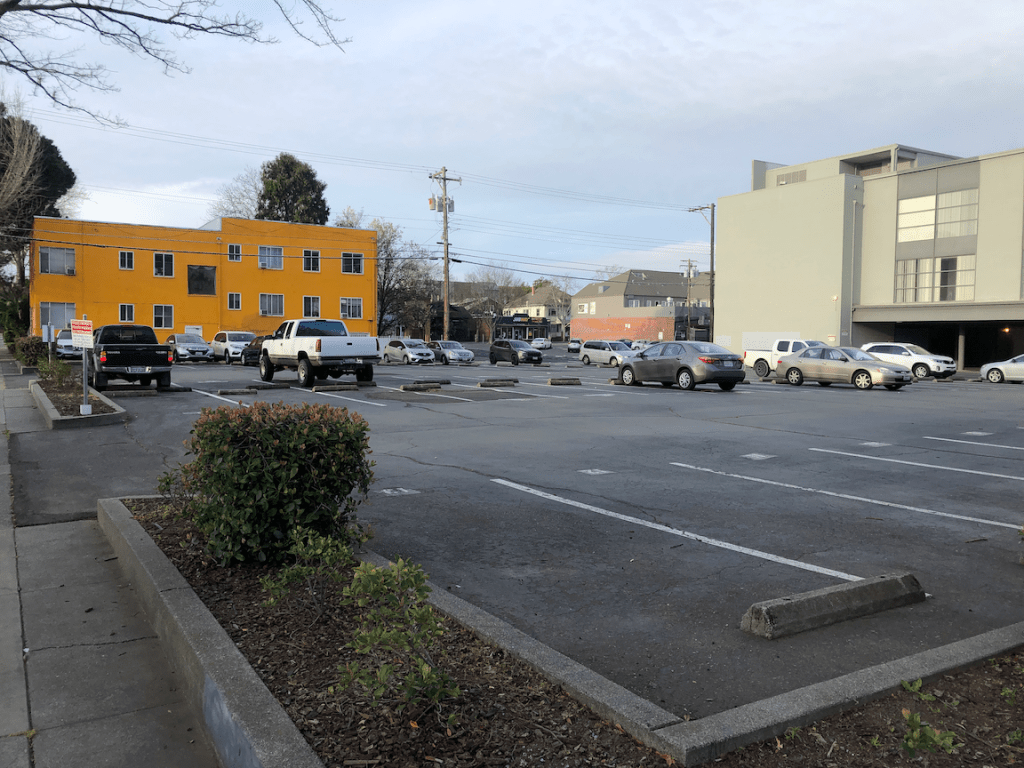

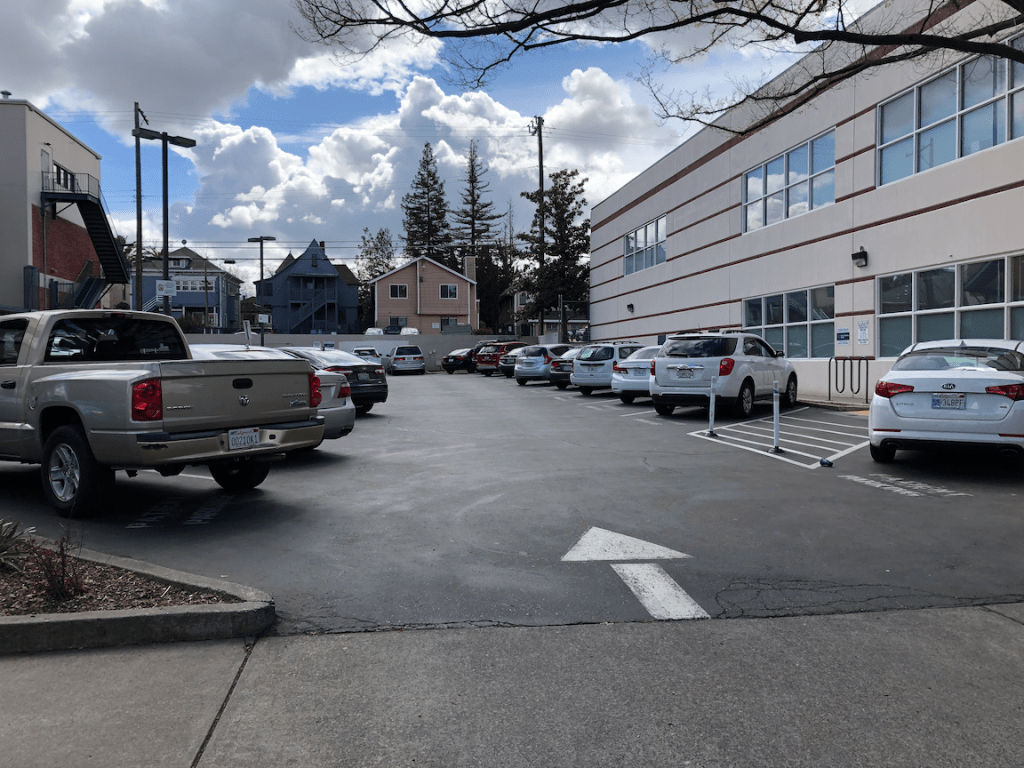

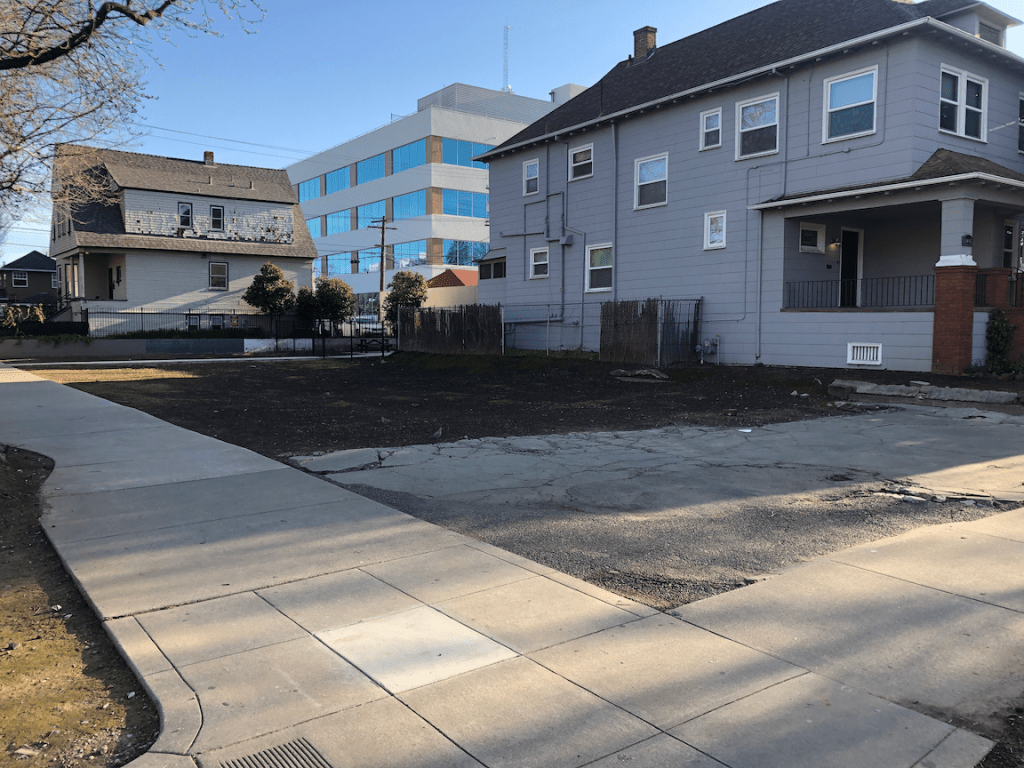

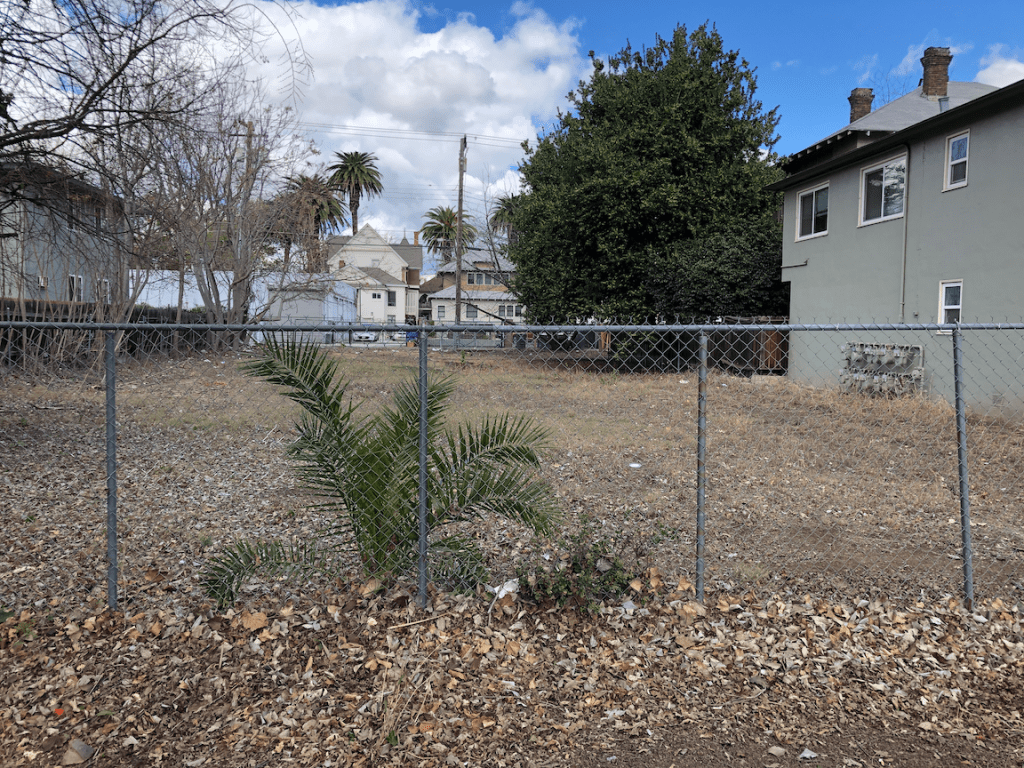

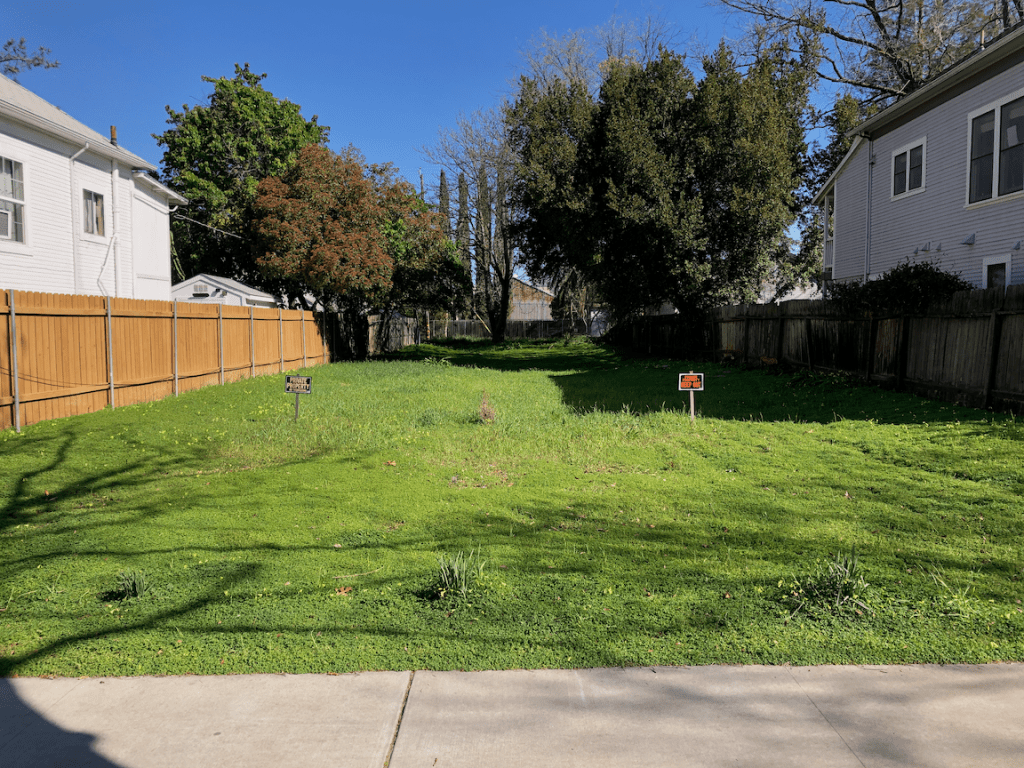

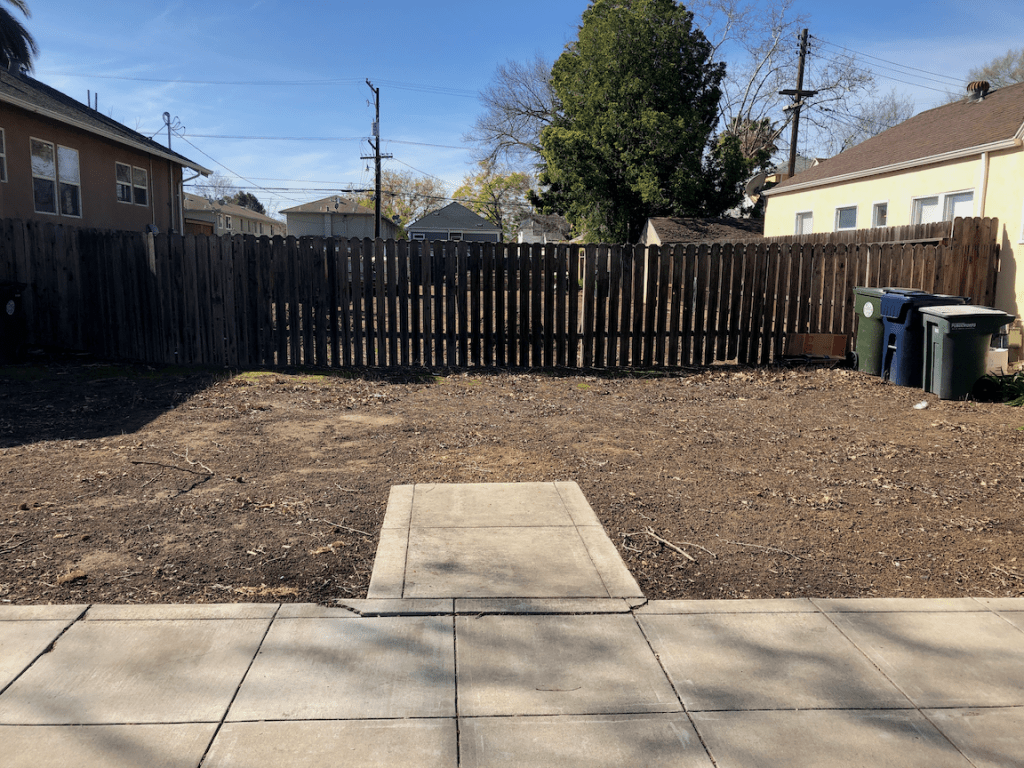

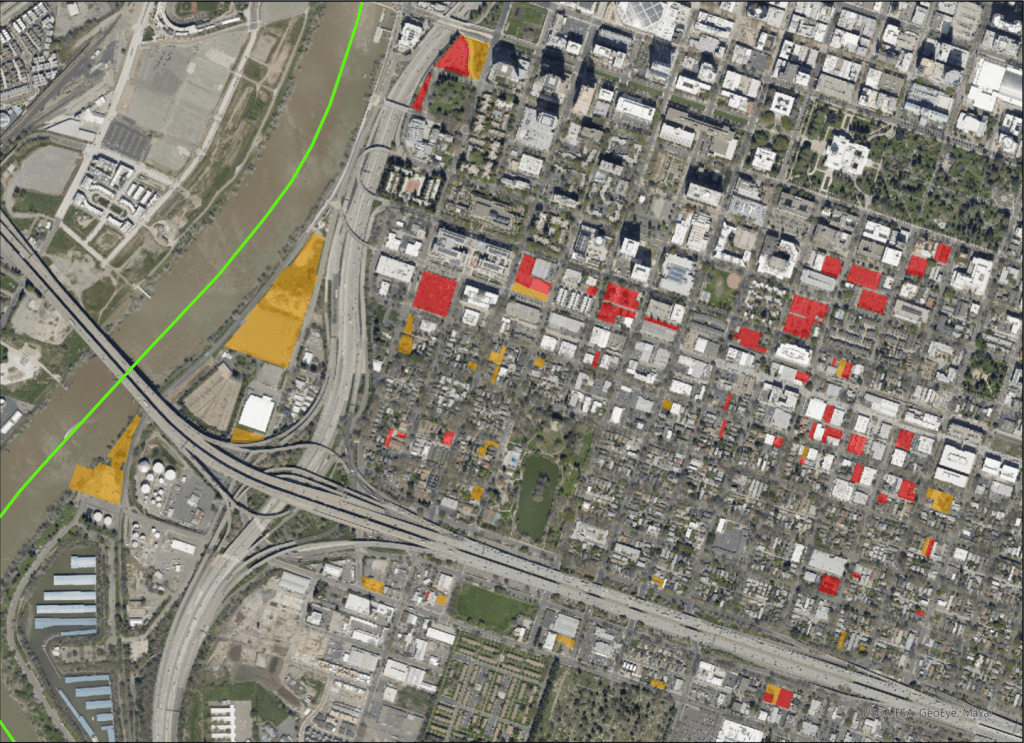

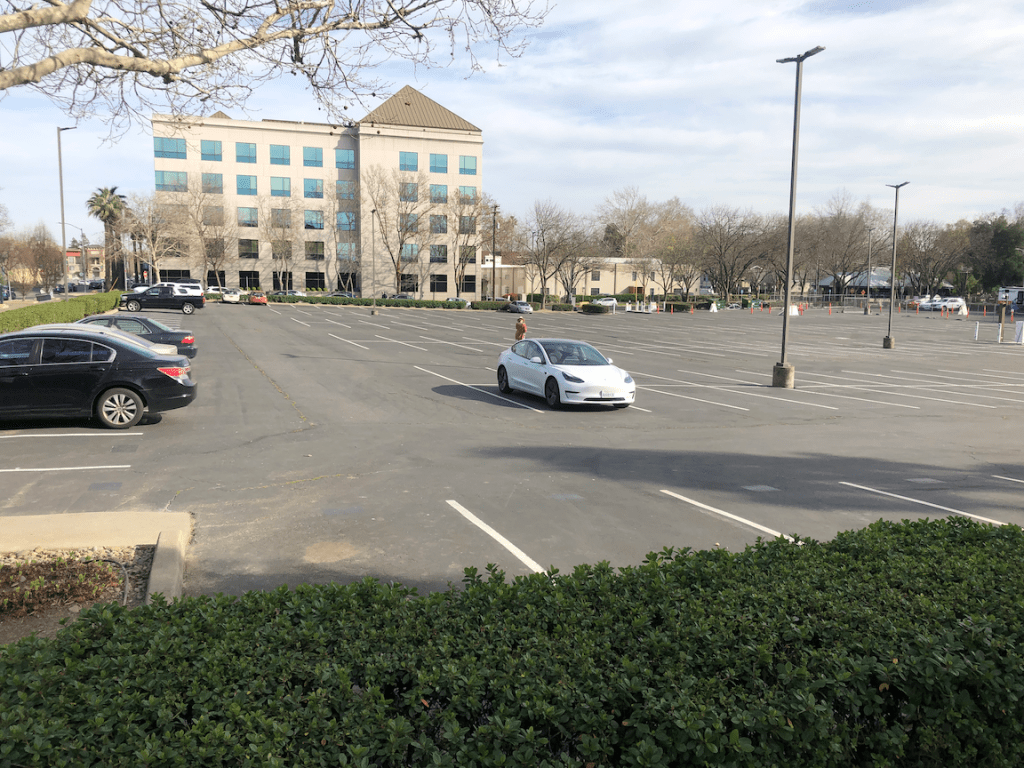

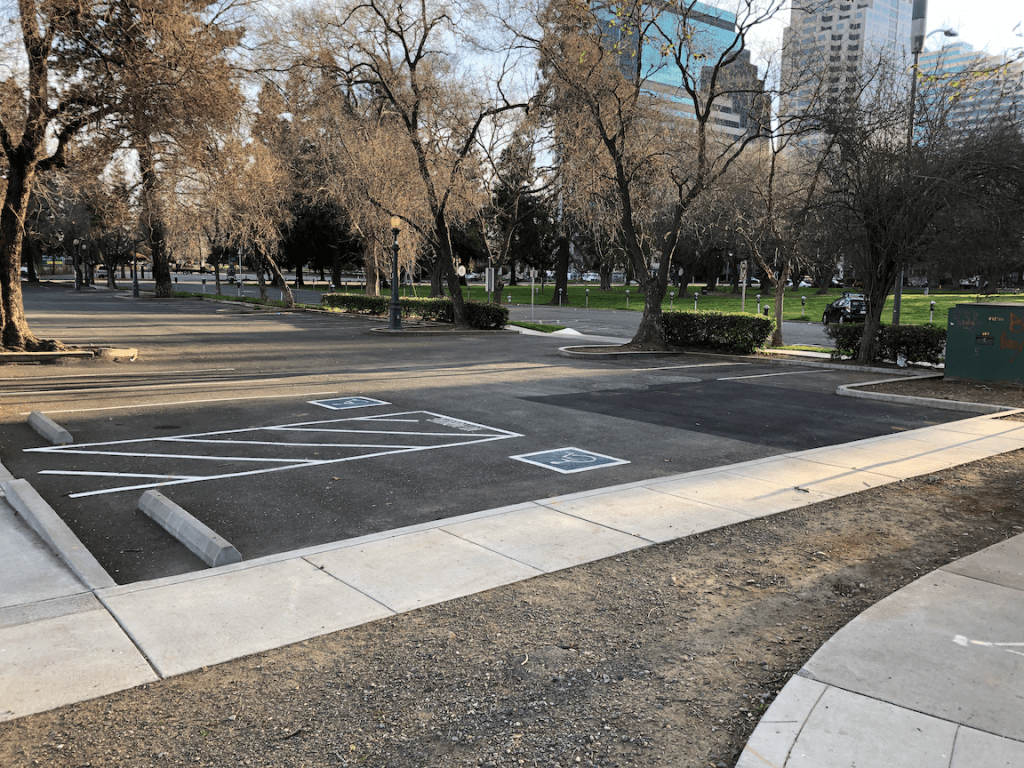

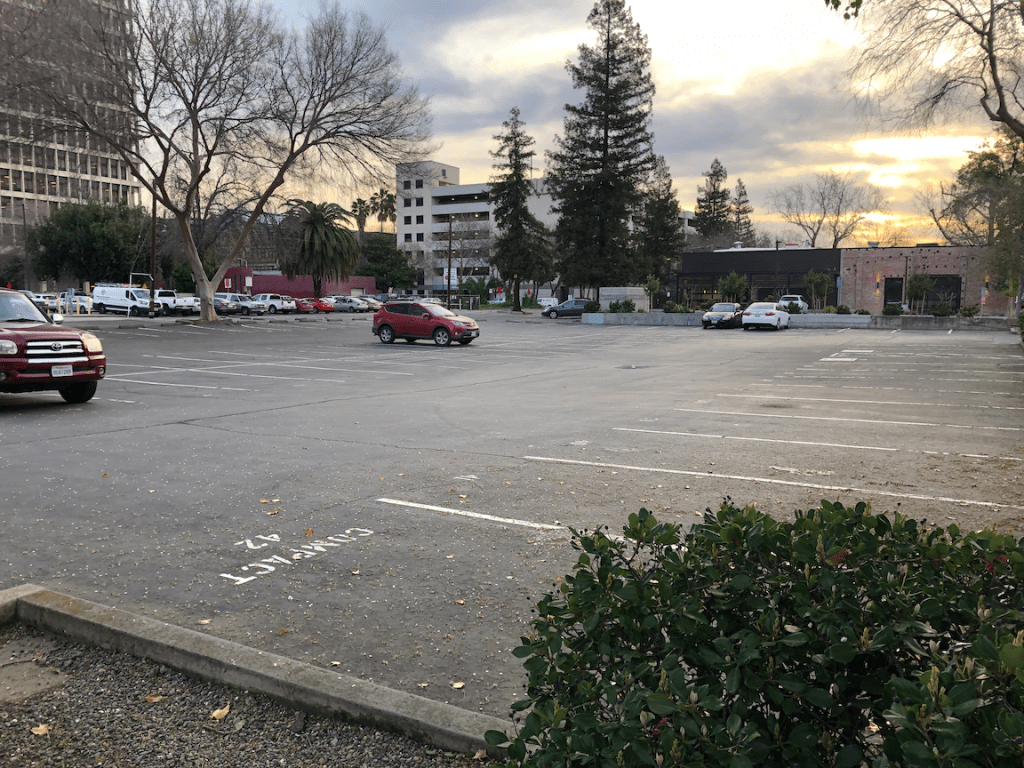

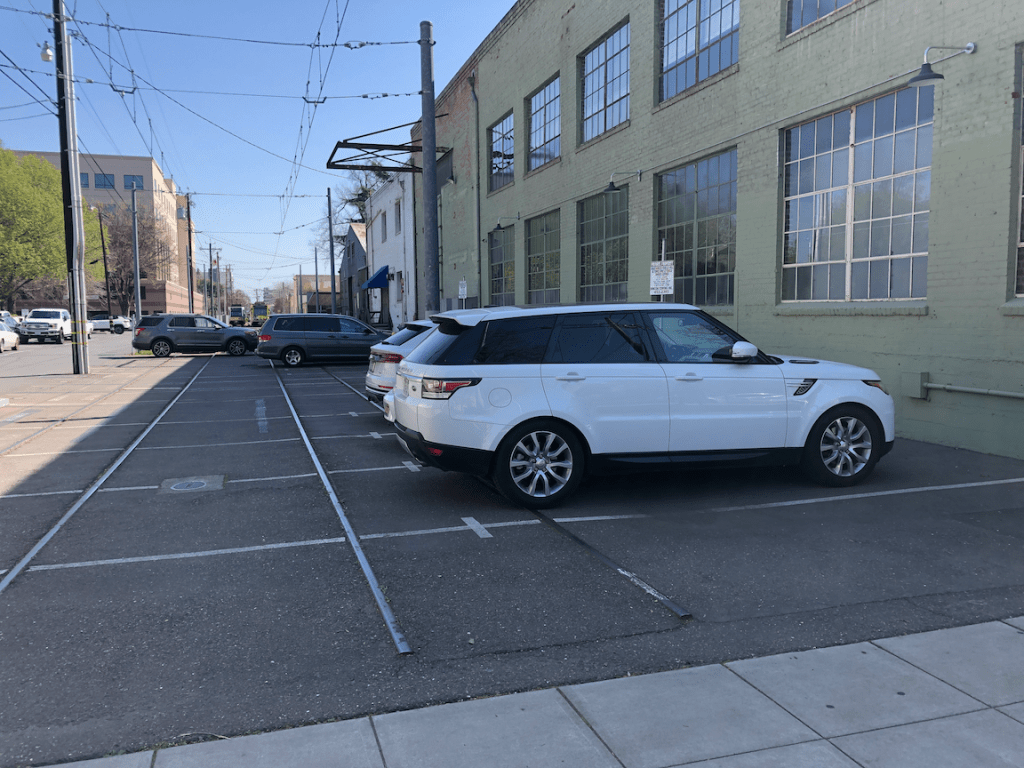

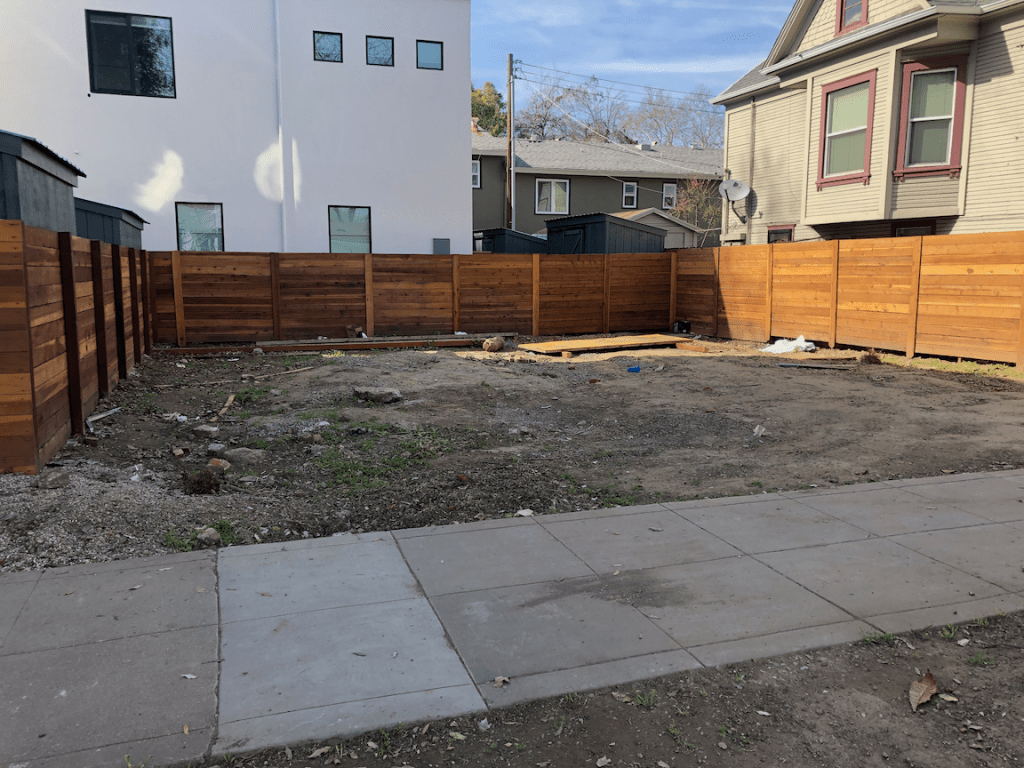

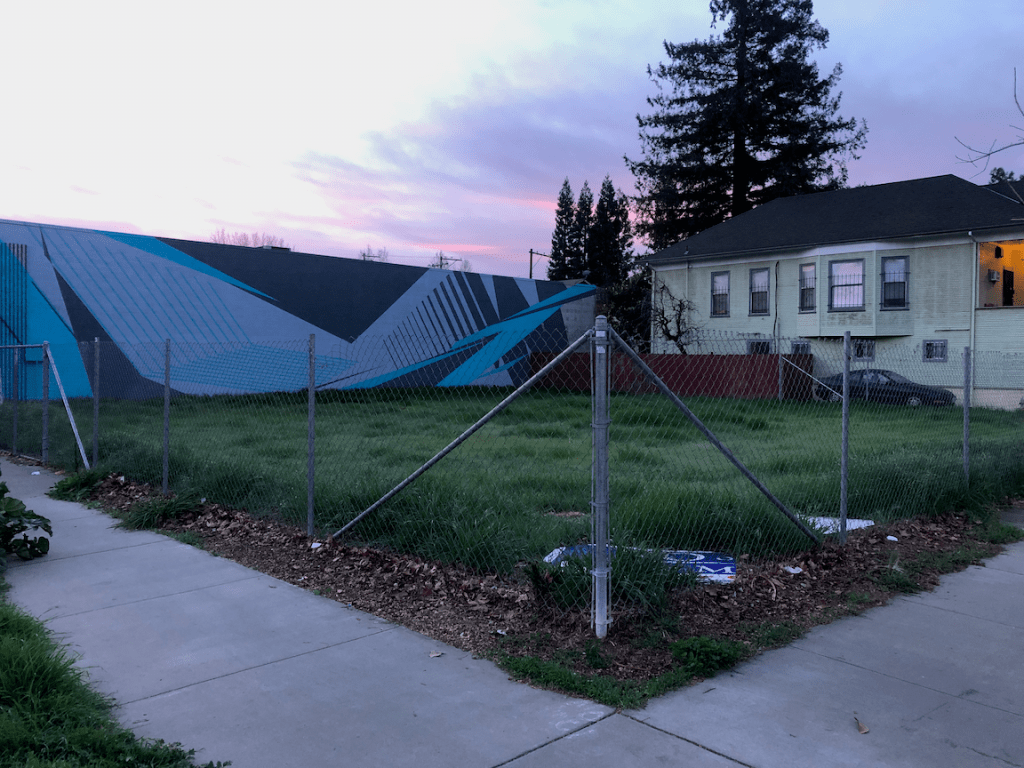

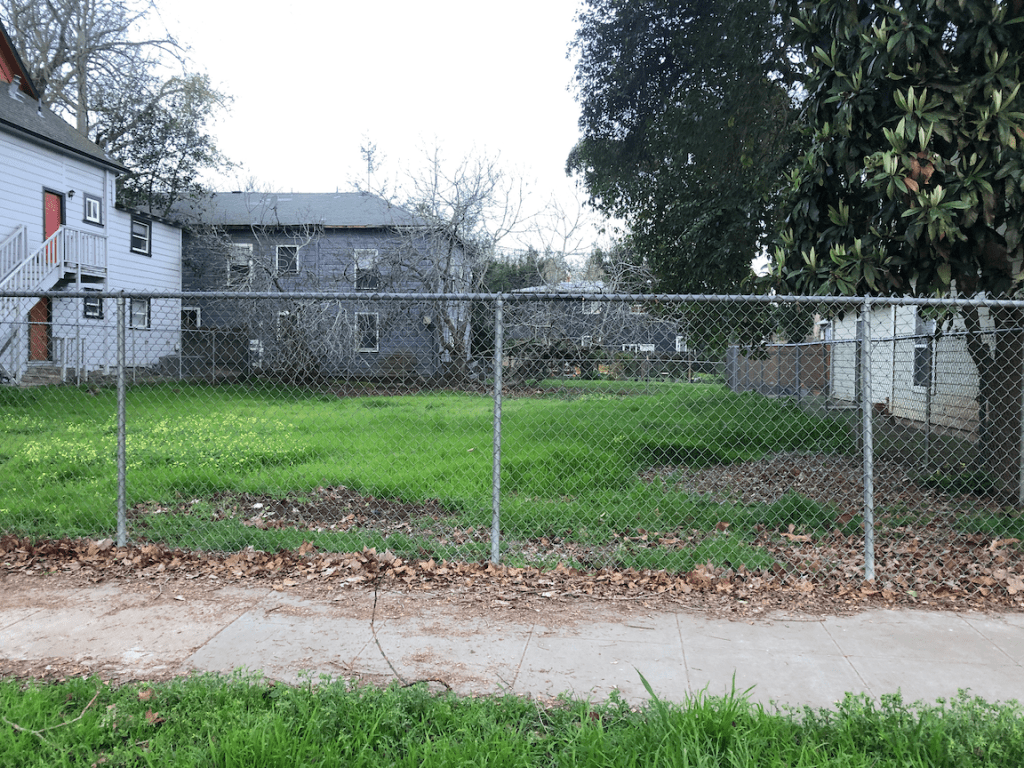

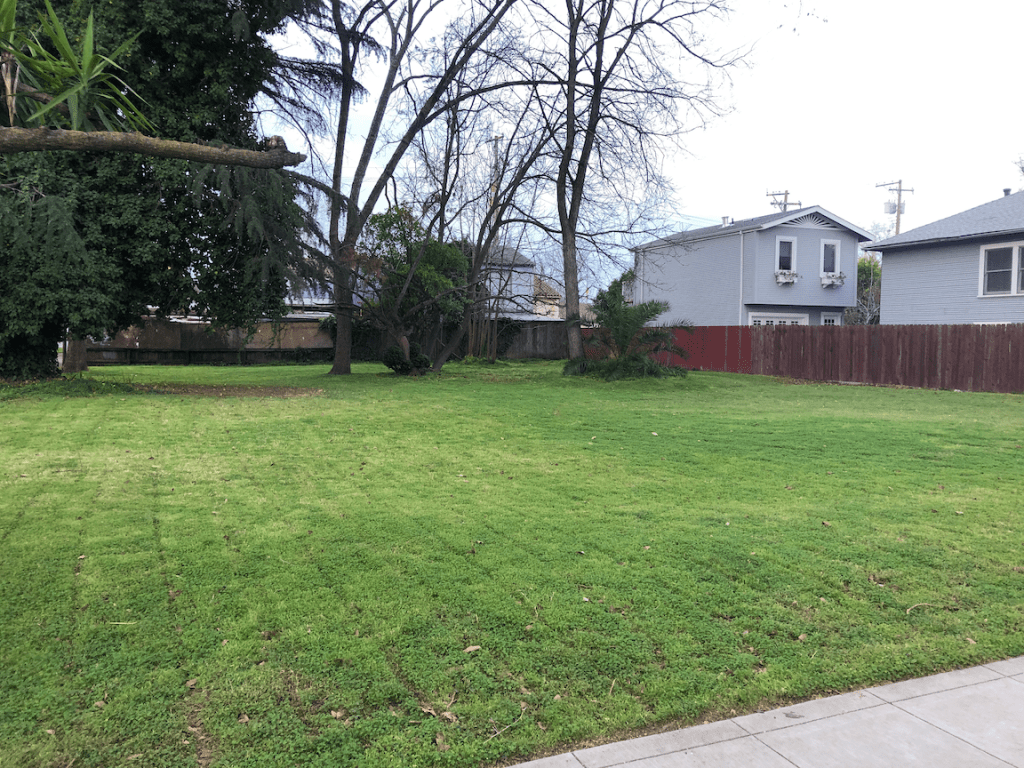

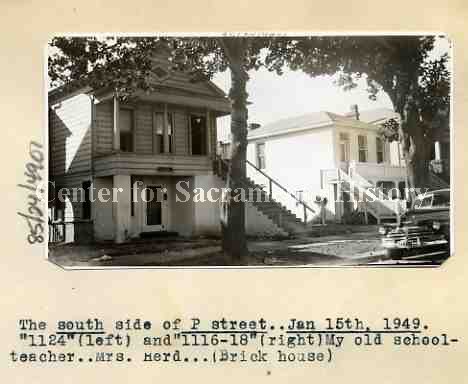

Why tax the land? Speculators often leave property undeveloped or vacant in hopes of future high profits at development or sale. There are many such parcels in Sacramento, many of them undeveloped or vacant for decades. Why? The owner pays property taxes, but the value of the property is a small fraction of the value of the improvements, and the improvements are zero, so the property tax paid is a fraction of what it would be if the parcel were in productive use.

The result of improvements-based property taxes is that parcel remain unused. If there were a true land value tax, the owner would want to develop their parcel right now, so that they would receive income from the use to offset their property tax. But with the current mixed property tax, there is almost no incentive whatsoever to develop or redevelop. The result? Far less housing that we would otherwise have.

A shift to valuing the land as a greater percentage of the allocation between land and improvements would help. I have searched for the percentage allocation in Sacramento County (the counties, not cities, administer and collect property taxes, but haven’t been able to find it. It may be one of those black boxes that assessors want to keep from the public.

I am not sure whether a land value tax could be implemented at the county level without changes to state law. It seems that state law tightly controls adjustments to total valuation and tax rates, but so far as I’ve found, does not control the allocation to land value and improvements value. If you can point me to resources for better understanding this, please comment.

NY Times: The ‘Georgists’ Are Out There, and They Want to Tax Your Land, Conor Doughherty